Silver and Gold Price per Gram or Kilo in Different Currencies

Below is the live gold price per gram listed in US Dollars on a daily basis as opposed to the more traditional gold price per ounce. Also shown is the silver price per gram.

Add your comments at the bottom of the page.

These prices are slightly delayed and are best used for getting an indication of the price of gold and silver for different weights and currencies.

For a wide range of real-time spot prices for precious metals, commodities, world markets and currencies try our main spot prices page.

Select the options that suits your needs best. Enjoy...

Your Choices:

- 3 types of weights; grams, kilograms and ounces - defaulted to ounces.

- 47 different currencies - defaulted to USD.

- 12 different time scales - defaulted to daily.

I have also included silver as it plays an important part in the precious metals investment world and is often used as a substitute for gold bullion investment.

Where it is more common to see the price of gold per gram, it is not usually the same for silver due to its increased bulk. This can normally makes kilograms a more appropriate weight to use than grams. But for the sake of like-for-like, I have defaulted the silver to be grams which you can easily change by using the weights drop-down box.

Why Gold Price per Gram?

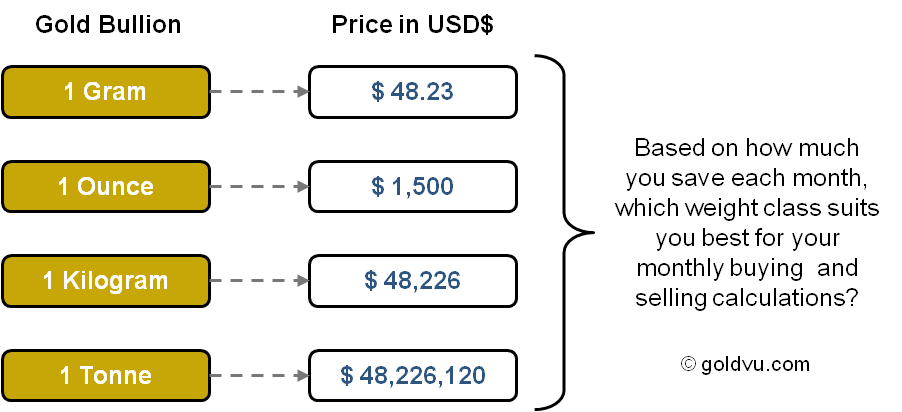

For any given weighting metric, gold bullion has a high monetary value when contrasted to other assets which can sometimes make it difficult the average investor to manage if they have limited funds.

It can be much easier to track, calculate, buy and sell in grams then in larger units such as kilograms or the traditional troy ounce.

For those that are more used to using ounces or wish to convert ounces to grams, the number of grams to a troy ounce is:

31.1034768 grams = 1 troy ounce

So using the figure in the above diagram of USD$ 1,500 per ounce to calculate the gold price per gram you do the following calculation:

To get the gold price per kilogram just multiply the price per gram by 1000.

Change from Imperial to Metric

There is a steady and increasing use of gold price per gram and kilogram rather than the traditional troy ounce. This is due a gradual global move from imperial to metric measurements in general. In the precious metals world this move is being strongly influenced by the Chinese.

The Chinese refiners mint gold bars in metric values, normally kilograms, rather than the traditional standard 400 ounce LBMA Good Delivery gold bar specifications (which is actually a range of 350-430 ozs rather than an exact 400 ounce weight).

If you are wondering why the Chinese are able to create such changes is because they are both the world's largest producer and importer of gold bullion in the world and have been for over a decade. Their influence in the global gold bullion market has grown rapidly and they are now the dominant force behind physical gold bullion.

Many of the main refiners in the world are moving from LBMA to kilo as their primary minting weight. It won't be long before the LBMA standard is cast into history.

Have you visited our real-time spot prices page?

Authored by David Gibson:

Authored by David Gibson: