ABX Global Storage and Logistics Solutions

The ABX global storage facility is a truly global bullion solution delivered through a worldwide network of specialised secure logistic providers that are working in partnership with the Allocated Bullion Exchange (ABX).

We welcome you to add your comments at the bottom of the page, or follow our social pages:

The ABX's storage and custodial network of vaults are completely independent and outside of the banking system. This ensures that the stored allocated physical bullion of each investing client of GoldVu is protected from bank insolvency or financial crisis that would otherwise risk your complete access and management of your private bullion holding.

From concept to development, one of the core tenets of the ABX is that all investor physical is held on a wholly allocated basis, hence the name Allocated Bullion Exchange. It was the intention that the physical bullion’s full legal title is to held by the investor unencumbered by any 3rd party.

Physical bullion held within the ABX global storage network can also be fully segregated at the request of the investor, however, this capability only applies to a few of the products and it incurs a minor fee payable per bar. Segregation of the bullion is done through the use of electronic Vault Warrants (eVW).

ABX Global Storage and Logistic Providers

The secure logistic solution providers are internationally recognised and are among the largest specialised providers globally. These providers offer the highest quality secure, effective services and have a fantastic record of reliability. Financial institutions and brokers that use our institutional allocated bullion solutions will find interacting with the vaulting system to be a seamless experience.

Being globally reputable secure storage and logistic companies, they have in place a modern infrastructure that has cutting-edge security systems. These high security factors contribute to the provision of extremely competitive insurance policies. This helps to ensure that the ABX minimises risk & cost, maximises security whilst being able to focus on its own core offering to the benefit of GoldVu's clients.

The ABX global storage network is comprised of 3 secure logistics providers, with whom your precious metals will be kept.

Global Trading Hubs (USD)

The following three providers are used for the 7 major global trading hubs where the trade is denominated in USD.

Malca-Amit's secure vaults are used for the following ABX global storage locations:

- Hong Kong

- New York

- Singapore

- Zurich

Loomis International's (previously Via Mat) secure vaulting services are used at the following market locations:

- Dubai

- London

Brink's

Brink's was established in 1859 and are considered one of the oldest secure logistics companies in the world. Their vaulting services are used at:

- Sydney

Australian National Bullion Markets (AUD)

Brink's

Brink's is the sole vaulting provider for ABX's AUD bullion markets. They provide vaulting services at:

- Brisbane

- Sydney

All of the physical bullion held in all of the above ABX vaults worldwide are fully insured against loss, theft and damage.

ABX Global Storage Inventory Management

When a trade order is executed, the buyer's bullion will be held in the secure storage are of that market location's vault. The bullion will not be moved from that location until a request is made by the owner for it to be withdrawn from the ABX global storage network or relocated to another ABX market vault.

The Allocated Bullion Exchange's global custodial storage services are facilitated by a comprehensive inventory management system that is used across all of its worldwide precious metals markets which is an integral part of the ABX clearing and settlement system.

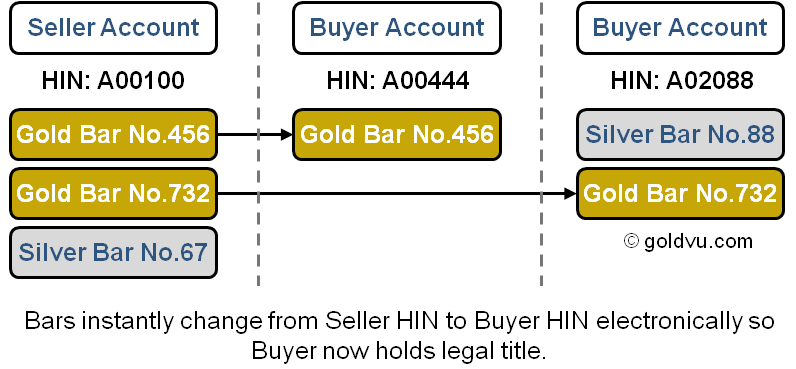

This inventory management uses Holder Identification Numbers (HIN) to track & apply ownership and legal title to each item of physical bullion (bars and coins) within the ABX global storage network.

The HINs are used for both segregated and unsegregated (pooled) physical bullion in order to ensure that it is all fully allocated.

None of the client names that are linked to the HIN are sent to Allocated Bullion Exchange by the brokers in order to create and safeguard trading anonymity on the exchange.

At the instant the trade order is executed, the bullion item(s) sold will immediately have the seller's HIN removed and replaced with the buyer's HIN which is now allocated against the product.

It is important to remember that unless specified, the bullion bought will not be physically segregated but kept in a pool of allocated bars. To have them segregated (which is only available for certain products) the electronic Vault Warrants (eVW) must to be used, for which there is a small additional fee.

ABX Global Storage Fees & Invoicing Management

Storage Fee Calculations

Storage fees are payable on all forms of physical gold, silver and platinum bullion products whilst they are kept in an ABX global storage vault.

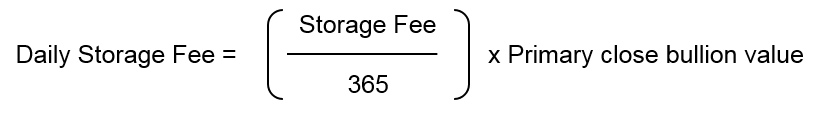

The storage fees for bullion are calculated daily and invoiced monthly in arrears at the agreed annual percentage rate. GoldVu has different storage fees and wholesale discount structures for private investors and corporate/institutional entities:

Storage fees are only calculated on the bullion value (USD or AUD, market location dependent) that is held by the investor at 5:00pm local time (primary close) in each trading hub. Bullion that has not yet been physically delivered to the respective vault will not accrue storage fees.

The daily storage fee is calculated by dividing our client’s respective storage fee, as determined by GoldVu, by three hundred and sixty-five (365) which is representative of the number of days in a typical calendar year, and multiplying this figure by the Central Holding's primary close bullion value of the client. This is represented in the following equation:

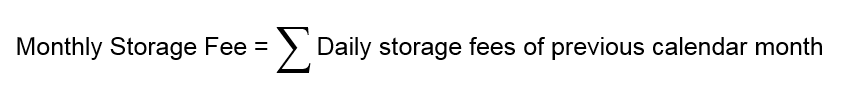

The Monthly Storage Fee charged shall be equal to the sum of the Daily Storage Fees applicable for the previous calendar month.

Invoice Management

GoldVu's clients will be e-mailed a storage invoice at the end of each calendar month for that calendar month. If you have bullion held at more than one trading hub, the invoice issued will be a single consolidated invoice for your entire Central Holding.

The invoiced fees can currently be paid through either MetalDesk with your available cash balance or by bank transfer to the bank account stated on the invoice.

Failure to Pay Custodial Storage Fee

What happens in the event of a banking crisis and something occurs to prevent you from transferring money to cover the payment of an invoice?

Such examples include capital controls preventing movement of cash, or a bank bail-in wiping you out so have no funds left to pay the invoice in the first place?

Heavy questions, but very important to ask. The answer:

GoldVu clients can still trade their vaulted bullion even if their invoice is unpaid for whatever reason.

This means that our clients can sell a portion of their Central Holding to raise a positive cash balance in MetalDesk that is sufficient enough to cover the outstanding custodial & storage invoice. You can then pay your invoice from this cash.

Now whilst you can continue to trade with an outstanding invoice, you are not allowed to withdraw cash or bullion from ABX until all outstanding invoices have been settled.

So there is no reason to not start immunising yourself from potential banking failures and systemic financial risk by opening a Central Holding with GoldVu. Become your own Central Bank and move your wealth outside of the banking system.

Withdrawing Bullion From the ABX Vault Network

GoldVu clients are able to withdraw bullion from the ABX global storage network and have it delivered to an approved location of your choosing (but that must be within the Central Business District of the market vault your holdings are stored at), or you can collect it directly from the ABX vault. See our associated fees for withdrawing bullion.

However, once you withdraw your bullion from the ABX global storage network, you cannot then sell it through the MetalDesk platform again. You will have to find an alternative method to sell it external to ABX's marketplaces, so make sure you have a plan on how to sell it prior to making a withdrawal.

We need to have at least 7 working days' notice for any bullion withdrawal. This gives ABX and the secure logistics provider enough time to make the necessary arrangements at their end.

Depositing & Delivering of Bullion Into the ABX Vault Network

The ABX global storage service operates on an allocated and unsegregated basis (segregation is an optional extra). The priority is to preserve the integrity of the bullion stored in the ABX global storage network.

Do Clients Have the Ability to Deposit?

Due to the absolute need to maintain bullion integrity, it unfortunately means that GoldVu clients cannot deliver coins that exist outside of the ABX Storage Network into an ABX vault.

However, bar deliveries may be considered, and only on a case by case basis pending the complete production of the required documents proving the bullion's full chain of integrity all the way back to the refiner of origin.

So Who Can Deliver to the ABX Vaults?

Only approved ABX Liquidity Providers eligible to deposit bullion into the ABX global storage network. An approved Liquidity Provider is usually either a Good Delivery Refiner as listed in ABX's Source List or an ABX approved assayer / inspector.

All bullion coming into the ABX global storage network must come either directly from the refiner or from the depositing member's storage facility. All of the bullion to be deposited must come with an accompanying Refiner Certificate (sometimes referred to as a bar list, or Refiner's bar list).

The deposited bullion must be accompanied by a bar list that states the refiner, serial number and receiving location for each of the bars being deposited. A completed paper trail proving the full chain of integrity from the refiner to the ABX global storage network needs to be established before the bullion can be accepted by ABX.

Deposit Process

Deposited bullion is initially delivered to the temporary storage area of an ABX Vault where it is then inspected and systematically verified. This process checks and cross-references the delivery request and associated supporting documents against the physical bullion's:

- Bar serial numbers

- Individual bar weight

- Fineness of each bar, as shown on its hallmark

- Brand on each bar, as shown on its hallmark

- The bullion is also checked to ensure that it is free from damage and interference.

If there are any discrepancies found during the above process, including damage or interference found to the bullion, then the bullion will be transferred to the quarantine area of the ABX vault.

Once complete, the bullion will then be approved for transfer from the temporary storage area to the secure storage area of the vault. Upon transfer, it is considered delivered into the ABX global storage & vault network. If your bullion is in a T+15 delivery trade cycle, it will be at this point that your Central Holding will be updated and you will then be able to trade it.

ABX Global Storage Auditing & Inspections

The ABX global storage network uses highly regarded industry specialists to provide inspection and audit services on all of the bullion stored within the global ABX vaulting network.

These services are provided by two companies:

- Inspectorate - which is the world's leading commodity quality testing company

- BDO - which is a large global accounting and auditing firm conducts the vault audits

Their combined services cover:

- Visual checks for bar number and brand purity

- Verification that the bar number records are accurate

- Weight checks on a random sample of metal bars

- Weight reconciliation of all bullion stored in each ABX vault location

- Calibration status checks for the scales at each ABX vault location

- Visual inspection of coins

- Full reporting of the findings of the inspections

To get access to the massive ABX global storage network, you will need to create a Central Holding with GoldVu first:

Authored by David Gibson:

Authored by David Gibson: