ABX Clearing and Settlement System

The ABX Clearing and Settlement system operates as the central counter-party to all trades, processing the movement & ownership of physical bullion and traded cash.

The Allocated Bullion Exchange acts as a central clearing facility for all 9 physical precious metals markets. The exchange has been designed from concept to be internal and self-clearing without the need for a 3rd party clearing house as it only processes and engages on the basis of full cash only trades. This clearing and settlement system is aided and supported by ABX's state-of-the-art global storage and logistics network.

No leverage is ever employed within the exchange to ensure that the internal ABX clearing and settlement process and client allocated assets have the smallest risk of being compromised through unassociated external financial events.

We welcome your comments and feedback which you can add at the bottom of the page.

However, prior to approval of full membership, each applicant is still given a financial health check which involves:

- Credit check

- Operational due diligence

- Initial guarantee fund deposit with the ABX

Full members are responsible for all positions that they carry on their books, to which the Allocated Bullion Exchange has no exposure.

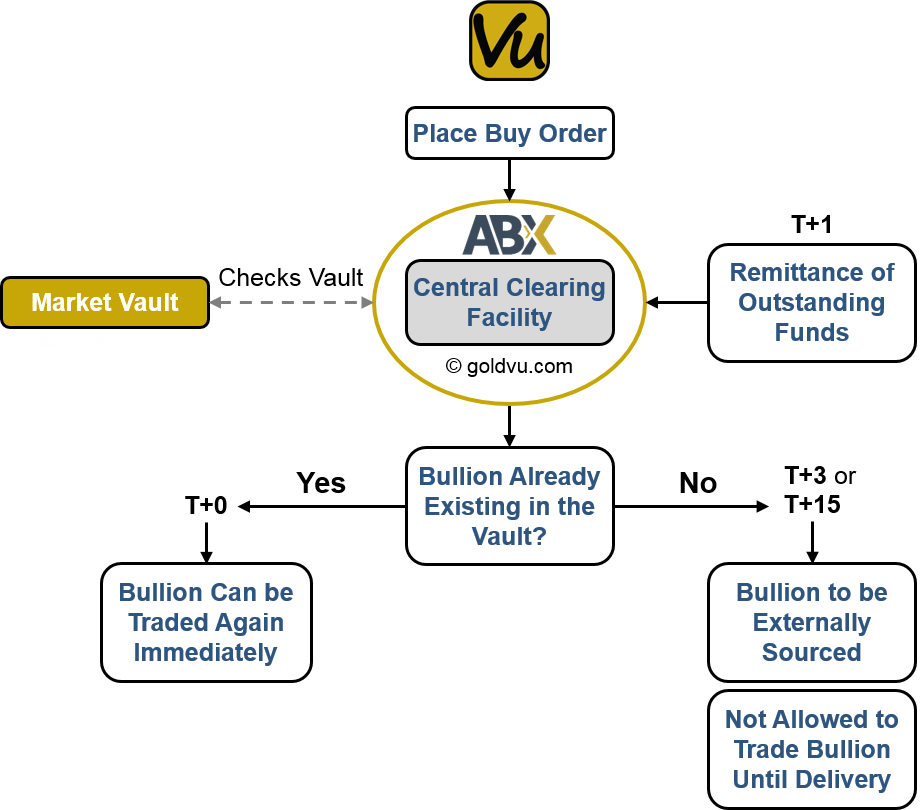

The ABX Clearing Process

For any exchanges trading in financial securities where they use instruments with leverage or have high settlement risk, such as derivatives, there is a monitoring requirement. The members of these exchanges are monitored for their ability to settle trades by analysing their corporate risk and capital adequacy.

The physical precious metal bullion on the Allocated Bullion Exchange isn't classified as a financial security / instrument. This is because there is no attached leverage, credit or loan exposure. However, institutions & brokers wishing to use the exchange's full brokerage trading platform will need to provide the appropriate regulatory certification. This is due to the institutional allocated bullion solutions the exchange offers allows for the bullion to be used as collateral to raise credit / margin capital that can then be reinvested into another asset class.

The ABX clearing and settlement process operates on a cash only basis. This cash only global physical bullion exchange creates a more operationally efficient and therefore a more cost-effective clearing process for investors and institutions to use.

The ABX Settlement Process

The Allocated Bullion Exchange has, and enforces, strict settlement rules to which every exchange member must adhere to.

In the event that an exchange member fails to settle on a trade, they will be subjected to full penalties and damages to the trade counter-party and the Allocated Bullion Exchange. Failure to meet the costs incurred during a set time period will likely result in the termination of their membership of the ABX.

The cash settlement and its corresponding transfer of legal title of ownership to the bullion item(s) occurs immediately upon trade execution.

Buying

When a trade participant buys a bullion item(s) on the ABX, their cash balance shown in MetalDesk is automatically debited with the full trade value plus the associated execution fee upon order completion.

If a limit order has been placed then the corresponding value of funds will be moved from your available cash balance into a 'Reserved Funds' status, where they will remain until the order is executed or cancelled.

Selling

When a trade participant sells a bullion item(s) on the ABX, their cash balance shown in MetalDesk is automatically and immediately credited with the full trade value consideration less the associated execution fee.

Funds

The following rules apply to funds (cash) connected with the ABX clearing and settlement process:

- No client funds are received directly by the ABX. They must all go via a Full Member of the Allocated Bullion Exchange.

- Funds are transferred by a client to the Full Member, with the Member settling the trade with the ABX.

- Where the client is registered with an Associate Member, the funds will be transferred via the Full Member that is acting as sponsor to that Associate Member.

- When a client withdraws funds remittance is made by the ABX to the Full Member.

- Fees charged to Members (Full & Associate) vary by monthly volume traded (in USD or AUD terms) and metal stored at the ABX (by total USD or AUD value).

This ABX clearing and settlement system is fully processed internally to increase the efficiency, speed and cost-effectiveness of the marketplace.

ABX Clearing and Settlement Process Times

The ABX clearing and settlement processing times are shown using the following syntax: T+0

- The letter 'T' refers to the Trade execution

- The 'number' equals the number of days passed following the execution of the trade

The primary ABX settlement process times are:

- T+0

- T+1

- T+3

- T+15

T+0

The ABX clearing and settlement system's default is to process all settle all bullion trades instantly at T+0.

Where the quantity of bullion traded is already physically within the Allocated Bullion Exchange vault, the legal title of ownership will be transferred instantly to the buyer.

If there is not enough bullion physically existing in that market's vault, that is available for trade, then any remaining and outstanding bullion needs to be sourced from outside the vault from the Liquidity Providers (ABX registered precious metals refineries). This outstanding bullion is placed into the T+ 3 or T+15 settlement term (dependent upon which market & contract type) under which the remainder of the trade order will be completed.

T+1

The remittance of any outstanding funds are required at T+1.

T+3

T+3 delivery currently exists in and Dubai, Hong Kong and Singapore. All three locations offer the 1kg gold contract and the 100 oz silver contract on a T+3 delivery basis.

T+15

Liquidity providers have a trade cycle which is up to a maximum of T+15.

Any trades awaiting completion with T+15 settlement terms will still have title of the bullion allocated to the buyer, same as if the trade was fully completed under T+0.

However, in the case of the Liquidity Provider's failure to deliver any of the outstanding bullion by settlement date, they will be subject to full penalties and damages to the trade counter-party and the ABX as per the exchange's rules. So basically, if a failure to deliver occurs, the buyer will be able to recover their money.

Only bullion that physically exists in the vault is allowed to be immediately traded.

Any bullion within the T+3 or T+15 trade cycle is not allowed to be traded until it has been physically delivered to the specified ABX market vault.

See further below for more details about the trade cycle.

How Do You Know What Settlement Term Your Trade Has Been Executed At?

Your Trade Confirmation document is automatically generated by MetalDesk and is clearly marked with the settlement delivery status and delivery date, depending upon the quantity of bullion physically available for trade in the specified market vault.

The trade confirmation will state either 'Deposited' or 'To Be Deposited'.

'Deposited' means that the bullion is already in the vault (T+0) and 'To Be Deposited' means it isn't in the vault and is awaiting delivery by the Liquidity Provider (T+3 or T+15).

The trade confirmation document will also show the delivery date of the T+3 or T+15 bullion into the ABX vault.

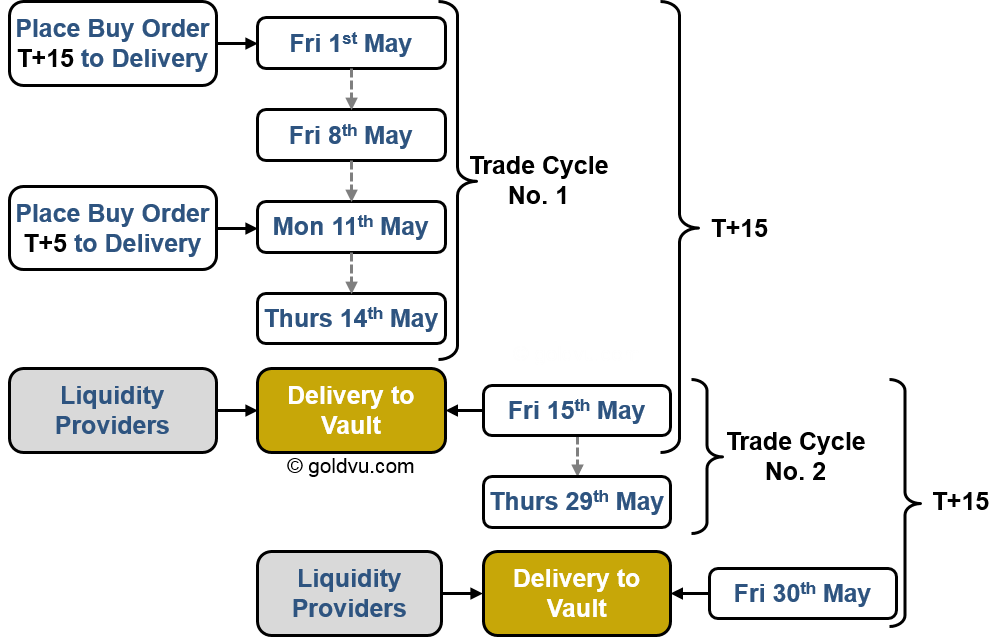

ABX Liquidity Provider Trade Cycle

The ABX clearing and settlement trade cycle for Liquidity Providers lasts 2 weeks.

The cycle starts on a Friday and ends on the Thursday 2 weeks later. The following cycle starts again on the next day, Friday, and then follows the same cyclical pattern.

At the end of every trade cycle, the Liquidity Providers have until the following Friday to meet all their bullion delivery obligations by physically depositing the required bullion into the relevant ABX market vault.

Irrespective of where the order enters the trade cycle, the outstanding bullion must be delivered at the end of the cycle in which it entered. Therefore no order can be expected to have a trade cycle of more than T+15.

This trade cycle allows Liquidity Providers the time to amalgamate orders over a 2 week period and deposit greater quantities of bullion into the ABX vault network at one time. This way the Allocated Bullion Exchange can provide the most competitive pricing on all its products.

If you wish to trade on the Allocated Bullion Exchange as either a private investor or corporate / institutional entity, create a Central Holding with GoldVu:

Authored by David Gibson:

Authored by David Gibson: